Understanding the Current Economic Landscape

The term economic recession is making headlines again—and for good reason. With inflation, rising interest rates, and global uncertainty, many Americans are wondering: Are we heading into another downturn? Let’s break it down in simple terms and explore how you can protect yourself financially during turbulent times.

What Is an Economic Recession?

A recession typically means two consecutive quarters of declining GDP (Gross Domestic Product). But what does that really look like in everyday life?

- Slower job growth or even layoffs

- Decreased consumer spending

- Stock market volatility

- Tighter lending conditions

All of this can impact your income, savings, and ability to invest or borrow.

Why Is the U.S. Facing a Possible Recession in 2025?

Several factors are contributing to concerns:

1. High Interest Rates

The Federal Reserve has been aggressively raising interest rates to control inflation. While that helps curb rising prices, it also makes borrowing more expensive—slowing down businesses and household spending.

2. Global Market Instability

Trade tensions, geopolitical conflicts, and a cooling Chinese economy are affecting international supply chains and investor confidence.

3. Corporate Layoffs

Major tech and finance companies have announced significant layoffs in early 2025, indicating companies are preparing for leaner times.

How a Recession Affects Your Money

Here’s what you might experience:

- Lower job security

- Rising credit card debt due to higher interest rates

- Decline in investment portfolios

- Housing market slowdowns

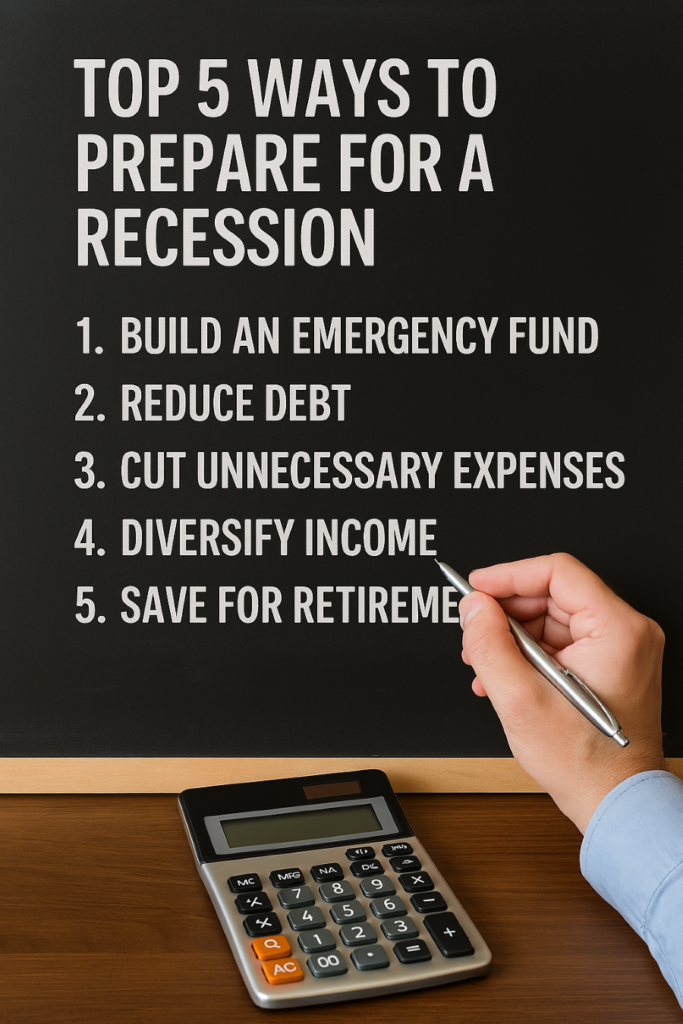

Smart Financial Moves to Make Now

You don’t need to panic—but preparation is key. Here are practical steps to protect your money:

1. Build (or Boost) Your Emergency Fund

Aim for at least 3–6 months of essential expenses saved in a high-yield savings account.

2. Review and Trim Expenses

Cut non-essential subscriptions or luxury purchases. Focus on needs, not wants.

3. Reassess Investments

Talk to a financial advisor about diversifying your portfolio. Recession-resilient sectors (like healthcare and utilities) may perform better.

4. Avoid Unnecessary Debt

Now is not the time to take out large loans or rack up credit card debt.

5. Explore New Income Streams

Freelancing, consulting, or selling digital products can provide valuable side income.

Is It All Doom and Gloom? Not Necessarily

While recessions are challenging, they also create opportunities:

- Real estate prices may drop—great for buyers

- Stocks could be “on sale” for long-term investors

- You may finally take control of your budget and goals

Remember, many people build wealth during recessions by staying calm, informed, and proactive.

Prepare, Don’t Panic

Recessions are part of the economic cycle. Instead of fearing them, use this time to take control of your financial future.