Starting to invest in the stock market can be intimidating, especially for beginners. But the good news is, with the right knowledge and a careful approach, anyone can take their first steps toward building a solid financial future. In this article, we will share valuable investment tips for beginners and show you how you can start in the stock market simply, safely, and effectively. Let’s dive in!

Understand the Basics: What Are Stocks and How Does the Market Work?

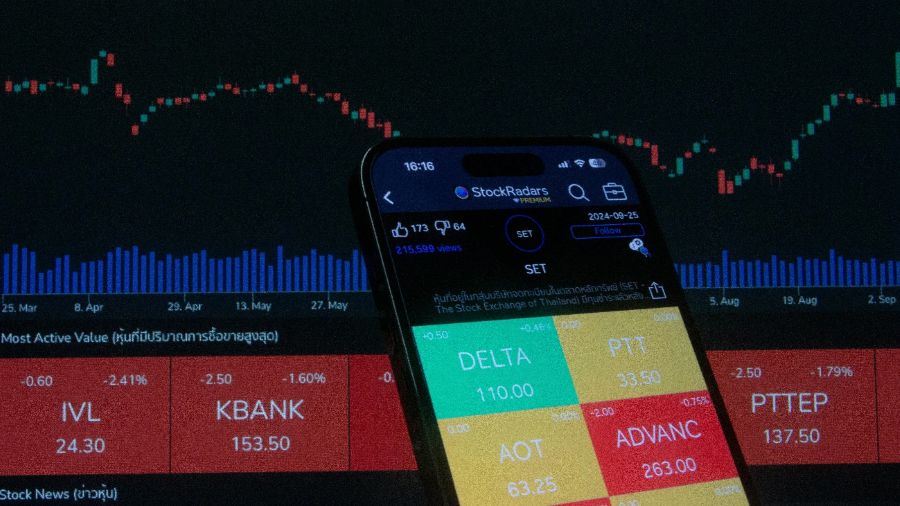

Before you begin, it’s essential to understand what stocks are and how the financial market works. Simply put, stocks are small shares of companies that you can buy and sell on the stock exchange.

Why invest in stocks?

- Potential for high returns: Historically, stocks have proven to be one of the most profitable investment options over the long term.

- Share in the company’s growth: By investing in stocks, you become a “partner” in the company and can profit from its growth.

Beginner Tip: Before you start investing, keep in mind that the stock market can be volatile. That means stock prices can rise and fall quickly, which is part of the process.

Define Your Investment Goals

Before you start investing, it’s crucial to know why you are investing. Setting clear goals will help you create a more effective strategy and avoid impulsive decisions.

Examples of investment goals:

- Retirement: If you’re thinking long-term, the goal is to invest to ensure a comfortable retirement.

- Buying property or taking a trip: For short or medium-term goals, your investment strategy will differ.

- Building wealth: If your aim is to grow your wealth over time, you may focus on safer stocks or even index funds.

By defining your goals, you’ll be able to select the most suitable investments based on your personal profile.

Start with Exchange-Traded Funds (ETFs) to Diversify Your Portfolio

If you’re just starting out, it might be wiser not to invest directly in individual stocks. A simple way to diversify your investments is by investing in Exchange-Traded Funds (ETFs).

Why start with ETFs?

- Diversification: ETFs consist of multiple stocks from various companies, which reduces risks, as you’re not relying on a single stock.

- Lower costs: ETF management fees are typically lower than directly purchasing individual stocks.

- Easy access: You can buy and sell ETFs directly on the stock exchange, just like stocks.

Golden Tip: ETFs can be an excellent choice for beginners because they help diversify your portfolio without requiring expert knowledge of the financial market.

Research Companies Before Investing in Individual Stocks

If you decide to invest in individual stocks, it’s crucial to conduct thorough research. Learn about the company, its financial performance, and the industry it operates in.

What to look for when choosing individual stocks:

- Financial health: Check the company’s financial statements to see if it has strong profits and low debt.

- Growth prospects: Companies with strong growth potential tend to offer higher long-term returns.

- Management quality: A competent management team can be a key factor in a company’s success in the market.

Investing in individual stocks requires more attention, but with proper research, it can lead to satisfying results.

Avoid Trying to Predict the Future: Invest Consistently

One of the biggest traps for beginners is trying to “time the market” or find the perfect moment to invest. The stock market is unpredictable, and accurately forecasting the future can be risky.

How to avoid this mistake:

- Invest consistently: Invest a fixed amount each month, regardless of market fluctuations. This is known as a dollar-cost averaging strategy.

- Be patient: The stock market works best over the long term. Don’t expect quick results, and try not to panic during temporary dips.

This strategy helps smooth out market fluctuations and prevents impulsive decisions.

Control Your Emotions and Stay Disciplined

Investing in stocks can be exciting but also stressful. The financial market can fluctuate, and it’s important to stay calm to avoid making impulsive decisions that could harm your investments.

How to maintain discipline:

- Create an investment plan: Set a strategy and stick to it. This includes deciding how much to invest, where to invest, and for how long.

- Avoid hasty sales: If you have a long-term plan, resist the urge to sell your stocks during market downturns.

- Review your portfolio periodically: From time to time, reassess your investments and goals. Adjust your strategy if necessary.

Expert Tip: If market volatility is making you nervous, consider investing in well-established companies or more stable sectors, such as utilities or large banks.

The Importance of Financial Education for Beginner Investors

Continuous financial education is key to success for any investor. The more you understand about the stock market, the better equipped you’ll be to make informed decisions.

Tips to continue your education:

- Read books on investing: There are excellent books that simplify the financial market for beginners.

- Follow blogs and videos: Many experts share practical advice on blogs and YouTube.

- Take online courses: If you prefer structured learning, there are specialized infoproducts that can teach you everything you need to know about the stock market.

Important Tip: Education is an investment that always pays off, especially when it comes to managing your finances and investments effectively.

Ready to Take the First Step?

Starting in the stock market can seem daunting, but with the tips we’ve shared, you’re better equipped to take your first steps with confidence. Remember to always set your goals, research your options, and, most importantly, invest consistently and with discipline.